June 2021 'The future is already here - it's just not evenly distributed' - William Gibson

Wednesday 2nd June 2021

xxx gave me a fantastic analogy this morning. I was telling him its difficult dollar cost averaging at the moment, as share prices are sky high, but I stick to my plan and do it anyway.

Using VAS as an example (currently at $92.40/share) he looks at the price as being $920,400. It’s your ‘house’ that you can buy in parcels over time.

The management fee of VAS is 0.1% meaning it ‘costs’ $1000 a year to manage your ‘house’ if you have $1,000,000 worth of VAS.

He recently had an outdoor shower installed at his house and some other plumbing work done that totalled $1000 dollars. Add rates, other maintenance and repairs, electricity, water and the costs add up.

In March/April 2020 VAS was in the high $500,000’s, now it’s $920,400, not including the four distributions it’s paid since April 2020 and will continue to pay quarterly forever.

While price will continue to fluctuate forever, ownership will grow as you continue to buy, high, low and everything in between.

In other news, the state of Victoria has (surprise, surprise) extended the snap seven-day lock down for another seven days as COVID cases continue to rise.

Friday 4th June 2021

“The Theory of Investment Value offer timeless lessons on the concept of intrinsic value, the importance of dividends, and the value of a long-term perspective. In a era of heightened volatility and low investment returns, these lessons are more important than ever.”

This book was written in 1938.

Author John Burr Williams used this to express his views on investing:

A cow for her milk

A hen for her eggs

And a stock, by heck

For her dividends

An orchard for fruit

Bees for their honey

And stocks, besides

For their dividends

Wednesday 9th June 2021

Bitcoin (BTC) is officially legal tender in El Salvador, voted in 62 out of 84 votes in their congress, making it the first country in the world to do this.

BTC is down around 45%-50% from it’s high around a month ago. In the past 24hrs it dipped below $32,000USD.

On the other side of the world, it appears China has split up Jack Ma’s businesses giving controlling interests to people other than Jack. Ailbaba is one of the biggest businesses in the world and just like that he no longer controls it. Mind-blowing!

The duality of this world never ceases to amaze.

Thursday 10th June 2021

This from Noel Whittaker’s June newsletter https://www.noelwhittaker.com.au/

I thought it worth sharing.

An economics professor at a local college made a statement that he had never failed a single student before, but had recently failed an entire class. That class had insisted that socialism worked and that no one would be poor and no one would be rich, a great equaliser.

The professor then said, "OK, we will have an experiment in this class on this plan". All grades will be averaged and everyone will receive the same grade so no one will fail and no one will receive an A... (Substituting grades for dollars - something closer to home and more readily understood by all).

After the first test, the grades were averaged and everyone got a B. The students who studied hard were upset and the students who studied little were happy. As the second test rolled around, the students who studied little had studied even less and the ones who studied hard decided they wanted a free ride too so they studied little.

The second test average was a D! No one was happy.

When the 3rd test rolled around, the average was an F.

As the tests proceeded, the scores never increased as bickering, blame and name-calling all resulted in hard feelings and no one would study for the benefit of anyone else.

To their great surprise, ALL FAILED and the professor told them that socialism would also ultimately fail because when the reward is great, the effort to succeed is great, but when government takes all the reward away, no one will try or want to succeed.

These are possibly the five best sentences you'll ever read and all applicable to this experiment:

- You cannot legislate the poor into prosperity by legislating the wealthy out of prosperity.

- What one person receives without working for, another person must work for without receiving.

- The government cannot give to anybody anything that the government does not first take from somebody else.

- You cannot multiply wealth by dividing it!

- When half of the people get the idea that they do not have to work because the other half is going to take care of them, and when the other half gets the idea that it does no good to work because somebody else is going to get what they work for, that is the beginning of the end of any nation.

Tuesday 15th June 2021

It’s so easy to hold assets right now. Every week prices seem to increase. Knowing everything in life is temporary; helps keep the irrational behaviour away during less rosy times, not if but when they arrive.

A mate bought GEAR in replacement of VAS. GEAR is the ASX200 but leveraged at around 50%-65%. He gets the leverage of debt without carrying the debt himself. It’s been good for him thus far, as the market has gone up; GEAR has magnified the returns to date.

However, leverage works both ways and the down will be magnified when there’s a pull back. That’ll be an opportunity or scary or both, depending on your point of view.

Thursday 17th June 2021

Today major Australian banks (CBA, WBC, ANZ and St George) apps and websites are down. Customers cannot log in or transfer funds.

If/when we become a cashless society, situations like this will be magnified. I recognise people are time poor and drop their standards (in lots of areas of life) for convenience. In this case, to ‘tap and go’, but few things in life worthwhile are convenient.

Electronic currency, banking apps and the Internet have been a fantastic addition to our previous cash dominant society. In my mind though, they can and should co-exist.

On separate note, the censorship we endure via the mainstream media and most of the Internet today is criminal. Take this clip in relation to the COVID ‘lab leak’ theory https://www.youtube.com/watch?v=__Czlg1xLJA.

12 months ago, Facebook and others were censoring anyone raising this concern via their (bullshit) ‘fact checks’. Now, FB has reversed their stance on this issue. So was it even a fact in the first place?

The moment we censor communication/discussion we’ve lost. The road to hell is paved with good intentions.

On the investing side of things, yesterday the ASX hit an all time high and the S&P 500 recently did as well. The crypto market is still hovering around where it’s been in recent weeks.

Tuesday 22nd June 2021

Yesterday the ASX has its worst day in four months, today it’s back to green galore.

Old school LIC Milton (MLT) is potentially merging into Washington H Soul Patterson (SOL) later this year it was announced this morning.

MLT holders will receive three large fully franked dividends (totally 52cents) and shares in SOL at a 10% premium to Net Tangible Asset value. MLT’s share price jumped 16% today on the news. So anyone who wants out gets rewarded too.

Interestingly, MLT didn’t ‘smooth’ the dividends enough during the past year. Now it’s known they have 0.37cents to pay out to shareholders as part of the $0.52 cent dividend, plus franking credits. Question is, why wasn’t more of this cash reserve used to smooth dividends for shareholders in the past year?

Saturday 26th June 2021

Greater Sydney, the central coast and the Blue Mountains enter a two-week lock down this weekend, because of 29 cases of COVID in Sydney.

These lockdowns has been out of control for a long time in here in Australia and are showing no signs of slowing down.

We were told early on when the fear was fresh and unknown, it was to save hospital beds for sever cases/complications. So how are our hospitals doing now? How many people are dying from COVID now?

Then we have this from the WHO re: vaccines:

The World Health Organisation on Friday urged fully vaccinated people to continue to wear masks, social distance and practice other Covid-19 pandemic safety measures as the highly contagious delta variant spreads rapidly across the globe. “People cannot feel safe just because they had the two doses. They still need to protect themselves,” Dr. Mariangela Simao, WHO assistant director-general for access to medicines and health products, said during a news briefing from the agency’s Geneva headquarters. “Vaccine alone won’t stop community transmission,” Simao added. “People need to continue to use masks consistently, be in ventilated spaces, hand hygiene ... the physical distance, avoid crowding. This still continues to be extremely important, even if you’re vaccinated when you have a community transmission ongoing.”

The fear in Australia around as of June 2021 is out of control. Thankfully Singapore is beginning to lead the way in navigating out of this. No quarantine, no daily case numbers, etc.

Monday 29th June 2021

QLD today announced a snap 3-day lockdown of most of the state from 6pm tonight, with stay at home orders in place. We have four COVID cases in the state and two of these are in hotel quarantine…

The narrative around lockdowns is redundant. It’s school holidays in Australia and with Sydney in a two-week lockdown and now QLD for three days, the number of people with small businesses in the tourism and hospitality sectors continue to be destroyed.

On a macro scale the censorship around important discussions relating to our politicians and mainstream media muting conversation around dealing with COVID in the pursuit of control and financial gain is criminal, plain and simple.

Invest a few hours to get up to speed: https://open.spotify.com/episode/7uVXKgE6eLJKMXkETwcw0D?si=bFmFnOSNSx6ypNTfCaz8Fg&context=spotify%3Ashow%3A4rOoJ6Egrf8K2IrywzwOMk&dl_branch=1

The market doesn’t seem to care though. It’s doing it thing.

Wednesday 30 June 2021

Last day of the financial year here in Australia, which means it’s quarterly spreadsheet time.

Safe to say it been a fantastic 12 months for property and shares. There’s plenty of talk about impending inflation. Like anything, time will tell…

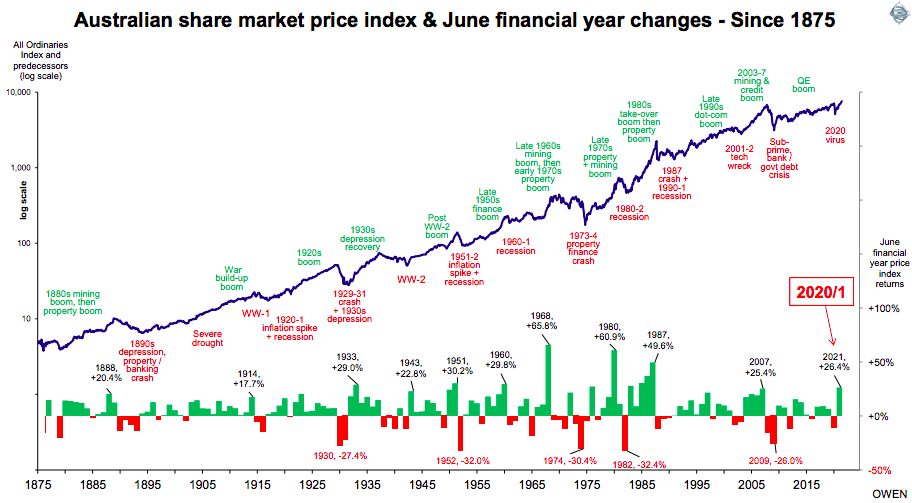

The ASX200 returned 24% this financial year. However, time frames matter. If we extend the time to include the 2020 financial year which retuned -11.3%, it’s no surprise 2021 was a good year. Averaging it out to a 6.35% return for the two year combined.

But and there’s always a but! It's all largely irrelevant. If you’d sold and went to cash during peak panic in March/April 2020 you’d be carrying a large opportunity cost.

If you’d bought more during March/April 2020 you’d be up way over the average 6.35% return for the two years.

And if you started investing in some time in 2021, you’d be up a little thinking this investing thing is easy. What all the fuss about?!

The only thing that matters is what we do. We cannot control or influence the market one bit, so, best we control the fees we pay and our investment behaviours.