July 2022 'Vitamins, if properly understood and applied, will help us to reduce human suffereing to an extent which the most fantastic mind would fail to imagine' - Albert Szent-Gyorgyi

Tuesday 5th July 2022

Today marks my 18th birthday working with USANA, the Cellular Nutrition Company. I’m finally an adult in the business! What a gift it’s been. I don’t have words to express how much I’ve learnt about health, human behaviour, leadership, events, culture, ups and downs, the media, friendship, support, courage, persistence, fun, creating change and the list goes on.

Another thing I didn’t expect was how much technology and society has changed since 2004. My business is so streamlined today compared to the mid to late 2000’s. When I started back in July 2004 it was foreign to order nutritional supplements and protein powders online and have them delivered to your house. These days no one bats an eyelid. It’s standard protocol.

Another thing I feel worth mentioning is there’s a great benefit to going through difficult things and doing difficult things. Just the nature of building teams and having large groups of people working together long term is a challenge. I’m better at understanding and facilitating this than I used to be, but have plenty of room for improvement at the same time.

I know I’m rambling but I’ve got a few more things to share around this.

I didn’t know it at the time but along the way I (finally!) learnt about finite and infinite games, as per Simon Sinik’s book The Infinite Game.

Finite games have:

- Know players

- Fixed rules

- Agreed upon outcome

Infinite games have:

- Known and unknown players

- Rules that are changeable

- The goal is to keep playing

Two parties playing the same game equals stability. Two parties playing different games equals instability.

Finite game players end up losing because the game of business is an infinite game, similar to the way life is.

For me a part of optimising long term health or ‘healthspan’ as some might call it, requires nutritional support long term. Omega 3’s, Vitamin D, Magnesium, Q10, joint support and the list goes on.

“In the long run, the choice between success and well-being is a false dichotomy.

The best way to achieve your goals is to lead a life that invigorates you - not one that drains you” - Adam Grant

From my experience businesses like USANA enable this.

I’m incredibly grateful to the thousands of customers who love the products, use them daily and have done so for many years. And to the hundreds of business partners here in Australia and around the world who had the courage to take a chance, step into what feels like the unknown, become business owners and the backbone of the economy, respect!

I look forward to another 18+ years operating USANA in the way I feel its in everyones highest and best good.

Today the RBA unsurprisingly hiked interest rates by 0.5% to 1.35% and signalled more rate rises in the coming months to curb inflation.

I’m wondering how much future interest rate rises have been priced in?

Friday 8th July 2022

More international political upheaval. UK Prime Minister Boris Johnson - gone! And former Japanese Prime Minister Shinzo Abe was tragically shot and killed during a speech in Japan today.

Monday 11th July 2022

Covid cases are up again which is no surprise being winter here in Australia. I think the government is promoting the 4th booster shot now and government doctor Kerry Chant telling people if you're sick and test negative to a rapid test stay home because the tests can be wrong.

So my question is then why test? If you’re not feeling well, rest and stay home. Pretty sure humans have been doing this for decades and find it odd the government feels the need to continually reiterate this.

Thursday 14th July 2022

US inflation rose again now sitting at 9.1%. You’ve got to look back and laugh at the ‘transitory’ inflation spin the FED attempted to promote months ago. It baffles me how these ‘experts’ didn’t realise essentially shutting the physical economy and giving people money wouldn’t result in inflation?

The FED are right up there with the RBA here in Australia who repeatedly said they wouldn’t raise interest rates until 2024. Another expert error. I’m not using hindsight bias to sound off on this. If you go back months you’ll see I didn’t agree with them at all.

Thomas Sowell sums it up perfectly ‘It’s hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions into the hands of people who pay no price for being wrong’.

This sadly sums up much of the western world’s public office ‘leadership’ and only reinforces the reality that no one is coming to save us. If it’s to be, it's up to me in this life.

Friday 15th July 2022

Canada has increased their interest rates a full 1% overnight, signalling that they mean business.

The US dollar continues to strengthen with it now on parity with the Euro.

Monday 18th July 2022

New Zealand reported its inflation hit 7.3%, its highest in 32 years.

Closer to home, a couple of vanguard ETFs I hold paid their quarterly distributions today. Mine are DRP’d to immediately buy more units. A total set and forget system for me.

The distributions of the past 12months have been unusually large. I’m guessing it’s got to do with two things.

Firstly a revision to the mean. When the physical economy was shut down during Covid distributions shrank quickly. Once the economy reopened profits soared to account for the pent up demand. However these two unique years averaged out equals a revision to the mean.

Secondly, some corporate changes. Mainly BHP being delisted overseas and its merger with Woodside. This resulted in some capital gains distributed back to unit holds of Aussie ETF indexes.

While it’s nice to receive large distributions, personally I’d prefer not to receive them due to tax consequences. Instead just leave them alone to compound. But such is the nature of holding a cap weighted index and in the larger scheme of things it’s a first world problem.

Thursday 21st July 2022

UK inflation increased to 9.4%. The UK’s highest inflation in 40 years.

Closer to home here in Australia, there has been a review launched at the RBA (Reserve Bank of Australia) after criticism of their handling of interest rates rising inflation. Time will tell if this is transformational or a PR exercise.

Friday 22nd July 2022

The European Central Bank has increased interest rates by 0.5% to 0%, its first rise since 2011.

Sunday 24th July 2022

Monkey Pox is now a thing according to the World Health Organisation, you’ll all be excited to learn. I wonder what the next thing will be… On a serious note, I think of the ‘Boy Who Cried Wolf’ story and hope we don’t suffer the same fate.

Tuesday 26th July 2022

Caught up with my mate Matt today. He’s a long time investor and suggested the headlines we’re hearing and seeing today are the same ones we’ve heard and seen forever and a day when markets decline. He suggested comparing headlines from decades ago to the ones we see today. I feel he’s spot on and it’s a great idea. I’ve not had a chance to compile them this month, so will report back on this in next month’s update.

Thursday 28th July 2022

In 2014 USANA had Tony Robbins come and speak at their annual international conference in SLC, Utah. I had qualified to be part of a VIP session he did for about 750 people which was a pure Q&A session with him. It was an insightful calm session, meaning none of the jumping up and down he's renowned for.

He talked extensively about a 1997 book called the Fourth Turning. Naturally I bought it, read it and can see why he valued it.

In the below YouTube video released this week, Tony interviews one of the authors (the other author has since passed) of the book giving a 2022 update. If you’re into this type of thing you’ll enjoy it.

https://www.youtube.com/watch?v=lX1Csk2vn5A&t=2028s

Staying in the US, listed companies are reporting earnings and so far it’s pretty good news.

The US FED also increased interest rates another 0.75% overnight and the market responded positively (price wise) to this new cash rate.

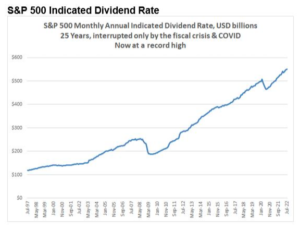

Finally the Animal Spirits podcast this week shared an image of the S&P 500 indicative dividend rate crossing $550 billion dollars for the first time. The dividend trend on the chart over the last 25 years looks good.

I remember Peter Thornhill saying ‘the earnings are the dog and the share price is the tail’. Most people have it around the wrong way.

Friday 29th July 2022

US GDP dropped 0.9% in the second quarter (in Q1 it dropped 1.6%) marking two negative quarters and a recession in the USA. Interestingly and not at all surprisingly, in the weeks leading up to this announcement, the Biden government has been spinning some BS around what actually constitutes a recession. They’ve changed the definition!

It’s literally impossible to believe anything from political parties and mainstream media these days. And spin such as this simply serves as more confirmation sadly.

Saturday 30th July 2022

Falling crude oil prices are making petrol cheaper. Now because I can’t control petrol prices, I don’t really care what I pay. I do my best to go through life not giving too much focus to things I don’t or cannot control. But for the sake of this diary, I paid $1.88/litre today. Around $0.60cents less per litre than a few weeks ago.

On the topic of fuel prices, did you catch POTUS Biden’s comment on petrol prices in the US and the reason for them being so high? I have no words…

Sunday 31st July 2022:

A friend has family in China and Taiwan. He told me for several months there’s been a run on banks in China (he’s not sure if all of China or certain provinces) so banks are limiting daily cash withdrawals. Apparently there’s been a bunch of protests with police intervening at times. Combined with their zero Covid policy it’s an interesting time in some of those provinces in China.

July has been a positive month for the market, with US reported quarterly earnings coming in at or better than expected, in the large companies that skew the index most because of their higher weightings.

That said, other than end of year reporting from some large Australian listed companies, I have no idea what August will bring market wise.