September 2022 'When setting out on a journey, do not seek advice from those who have never left home' - Rumi

Monday 5th September 2022

Last week BHP and Rio Tinto transferred a combined $20billion dollars to shareholders. This week sees another $5 billion dollars from names including Fortescue, CSL and Brambles.

$42 billion in dividends are being sent to investors bank accounts this month. Shareholders received $45 billion dollars in the December half year dividend payments.

Ashley Owen on the SB Talks podcast summed it up well.

In 2019 Australian companies had around $99 billion dollars in profits and paid out around $65 billion dollars in dividends to shareholders.

In 2021 this dropped to around $40 billion in profits and nearly $20 billion in dividends to shareholders.

In 2022 profits have bounded forward to over $100 billion dollars and dividends of closer to $100 billion dollars have been paid into shareholders bank accounts.

Both profits and dividends are higher than they were pre-covid.

Putting it another way, this is approximately equal to the $90 billion dollars it’s said the Job Keeper program cost that kept Aussies spending money during the lockdowns.

Tuesday 6th September 2022

The RBA increased the cash rate another 0.50% today taking the Australian cash rate to 2.35%. Still a low rate by historical standards.

Saturday 10th September 2022

Despite this being Project Passive the financial aspects always come second to health, peace of mind, people and experiences. That saying ‘love people and use things, because the other way around never works out well’ is accurate.

Interestingly I came across some research and I quote ‘satisfaction with family life and health are the strongest predictors while satisfaction with income and leisure time are the weakest predictors of overall life satisfaction for both genders’.

https://www.sciencedirect.com/science/article/pii/S0001691822002359

That certainly sums up my life experience thus far.

Tuesday 13th September 2022

In episode 95 of the All In Podcast (https://www.youtube.com/watch?v=s0tfoW1N3VM&t=3399s) David Friedburg spoke about the death of faceless brands in the next 10-30 years. I feel he is spot on.

The ability for anyone to build permissionless leverage via the internet today is monstrous. It’s the reason for the rise of the ‘influencer’ in recent years. We now have technology and platforms (YouTube, podcasts, websites, Instagram, etc) that didn't exist decades ago. I agree with Friedburg 100% and suggest listening to that episode for more context.

As a personal example, for direct sales businesses like I have with USANA Health Sciences, it has phenomenal potential for this way of operation.

Wednesday 14th September 2022

Inflation came in higher than expected overnight in the US over 8%. The market dropped 4-5% overnight as a result. It impacted the Australian market dropping around 2.5%.

If we don’t understand history we’re condemned to repeat it. History doesn’t repeat but it rhymes are both well known sayings.

I’ve been doing some light reading of the greatest Australian depression which happened in the 1890’s not the more known 1929 US Great Depression. It’s fascinating stuff. Check out these link if you’re interested.

https://www.rba.gov.au/publications/rdp/2001/2001-07/1890s-depression.html

https://www.australianfoodtimeline.com.au/1890s-depression/

One thing is for sure in my mind. The recency bias of property speculators is not going away anytime soon, unless acted upon by outside forces.

Thursday 15th September 2022

In December 2016 I was in a second hand bookshop in SanFrancisco with a funny feeling I’d find an epic book. The book I found was ‘Let My People Go Surfing’ by Clothing brand Patagonia founder Yvon Chouinard.

It’s one of the best books I’ve read and had a profound influence on me.

The philosophy of the book upon reflection was one of the reasons I partnered with USANA Health Sciences in 2004 and while fashion is not my strong point (anyone that knows me will confirm that) post reading this book, my wardrobe shifted to 90% Patagonia and 10% coaching/training clothing.

Patagonia founder/owner puts Patagonia in a Trust with the companies profits used to heal the planet in the way they see fit. Essentially, now Patagonia has one shareholder, planet earth.

Patagonia is an amazing company with an amazing story.

Wednesday 21st September 2022:

Incentives drive pretty much all behaviour. Charlie Munger said it best: ‘show me the incentives and I’ll show you the behaviour’.

This post by Morgan Housel is worth reading: https://collabfund.com/blog/incentives/

It’s been revealed in the internal review of the RBA for it’s decisions during covid, it bought $281 billion dollars of bonds during COVID in while the government borrowed billions of dollars including $90 billion for the job keeper program. The real cost of the bond buying program won't be known until 2033 when the last of the bonds matures. Interestingly, the RBA said it was ‘unsure’ what economic effect the bond buying would have on the market but would be prepared to do it again under extreme circumstances.

I find this fascinating. From my limited understanding, it went something like this… The world was in fear - some people sold shares and ran to cash because of this fear - but people also sold bonds to run to cash - for every seller there has to be a buyer on the other end of the transaction - not many people wanted to buy bonds - this is not a good scenario - people wanting to sell bonds with no buyers for them results in prices crashing - so the RBA stepped in with their bond buying program in effect stopping the market free fall and putting a ‘floor’ the market.

Things settled after the RBA’s actions. History shows the impact the RBA and other central banks around the world had on the market using these strategies for approximately two years.

We now have 8%+ inflation and it’s rising along with rising interest rates and the market is being re-priced.

The part I find fascinating is in physiology you cannot create an artificial high and not endure an equal low. We’ve seen this forever in people who repeatedly abuse alcohol and recreational drugs. The same thing happens in an economy.

Undisciplined people destroy their personal physiology (through excessive consumption and/or not enough production), the same as undisciplined people destroy their personal economy (through excessive consumption and/or not enough production).

In my view, we’re now seeing this happen at scale in real time.

Thursday 22nd September 2022

Today Australia remembers the Queen with a public holiday for her recent passing. Ironically next Monday is the annual Queen's Birthday public holiday.

Overnight FED Chair Jerome Powell announced another 0.75% interest rate rise and commentary around the likelihood of a ‘soft landing’ for the economy as a result of these interest rates rises diminishing.

This is significant for Australia in my view, because whatever the FED does influences the RBA more than the RBA would prefer the typical Australian to know.

As I understand it (and I could be off track…) if we don’t increase our interest rates as the FED in the US are, the value of our dollar will drop significantly. One of the key differences between the US and Australia is housing mortgages and housing debt in general.

In the US home buyers stay on the interest rate on home purchase for the life of their home. So repayments for mortgage holders in the US don’t increase even as interest rates do. The only reason they’d increase is if you decided to sell up and buy another property now, which without knowing the numbers, I’m certain is not happening as much as it was the past two years.

This is not the case here in Australia. Add to this, Australia is one of the most housing indebted countries in the world and rising interest rates will impact the cash flow of mortgage holders that will have a flow on effect in the economy.

The RBA’s hand will be forced - period. After all, the Bank of England just raised interest rates 0.5% and the Swiss National Bank just raised its rates by 0.75% and the Hong Kong Monetary Authority just raised rates 0.75% to a 14 year high of 3.5%.

We live in a global village more connected than most might realise. This was evident during the covid shut downs and supply chain challenges and is again evident now with central banks acting in unison.

Friday 23rd September 2022

The ASX is getting pounded today which is to be expected. Markets are generally efficient so assets are being re-priced based on higher interest rates. Because the share market is forward looking, my guess is we can expect this re-pricing action in all asset classes in due course should interest rates continue in the current direction.

I’m good with this because the lower prices go the greater the future returns will be. Plus I’m a positive investor. What that means is:

Asset prices rising? Great, I’m getting wealthier!

Asset prices contracting? Great, I can buy fantastic businesses for cheaper!

Keep in mind these are only my views and I’m sticking to them.

Monday 26th September 2022

Another red day on the market. I read online that 4.5 year Australian Commonwealth Bank bonds were yielding 4.9% but have been sold down recently now yielding 5.8%. Meaning when CBA wants to borrow money from overseas it will pay over 6% for this money. Other Australian banks will have to pay more.

These borrowing costs either have to be absorbed by CBA (unlikely) or passed on to mortgage holders (more likely).

If the AUD continues losing value against the USD, Australian bond yields will rise further and increase bank borrowing costs which will be passed on to the mortgage holders.

This episode of the JRE podcast is highly recommended. His guest, a former pharmaceutical salesman dishes the dirt on big pharma and the insurance companies in the US. It goes without saying prevention is better than cure when it comes to our health and wellbeing physically and mentally.

https://open.spotify.com/episode/30NOm1ioG5mpmoQCNEjNgF?si=H0fXQ729SRyUvowPew5-CQ

Thursday 29th September 2022

Overnight the Bank of England (BoE) announced they’ll be buying UK bonds. This will help settle the share market. As I understand it, the higher long term bond rates go the higher interest rates must go which is like gravity to asset prices.

The buying up of these bonds dropped them from 4% to 3.7%, the biggest drop in two years. But you know the saying, one swallow doesn’t make a summer…

Closer to home, inflation here in Australia has jumped to 6.8% in the year to August, impacted mostly by food prices. This increasing inflation is another driver to increase interest rates. It’s definitely starting to appear stormy looking out into the horizon…

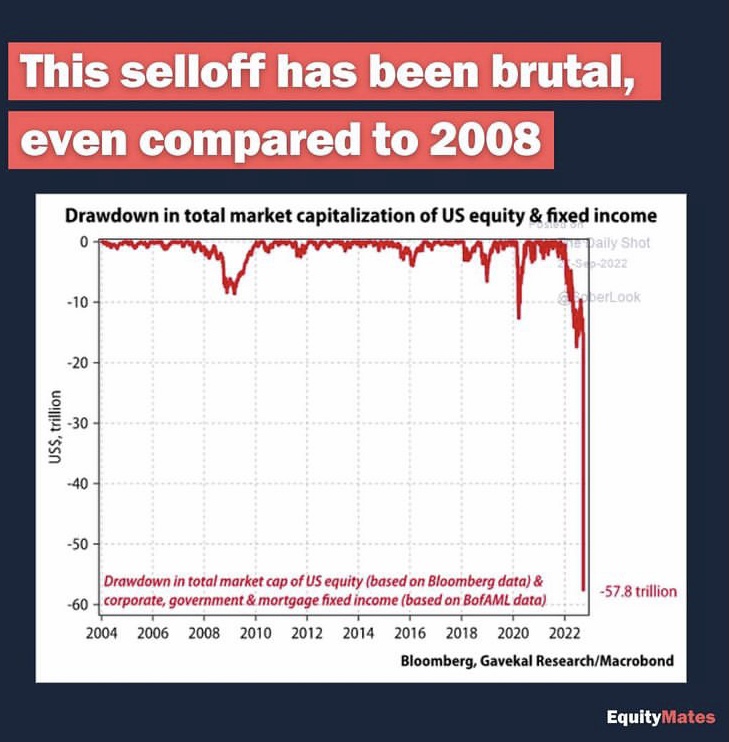

This chart (the image for the September 2022 monthly update on the website) is an incredible visual on just how much money (for lack of a better word) has been added to the economy. Sadly, this current drawdown in dollar terms, makes the GFC look like a walk in the park. The GFC was close to $10 trillion dollars in drawdowns whereas this current one is closer to $60 trillion dollars!

These absolute numbers are reflective of the insane credit expansion the last two years alone. It’s difficult to comprehend without viewing the chart.

Speaking of insane, Netflix has a great three part doco on the Game Stop saga called 'Eat The Rich'. It's worth checking out.

Friday 30th September 2022

The UK bonds thing didn’t last long, with the market down 2.85% overnight.

The lower the market goes the greater the expected future returns are.

Finally, I mentioned recency bias earlier in this month's diary and I’m convinced it’s impacting beliefs and behaviours more than most are accounting for currently. Of course I have no idea on what the future entails - outside of the certainty of opportunity mixed with difficulty - so mentally preparing for any number of potential environments seems like a good idea to me. I’ll use two simple examples.

Firstly Australian house prices. For 30 years interest rates have been falling correlating with rapid house price growth. The lower interest rates went, the higher house prices climbed. What happens to house prices in Australia if interest rates increase the next 30 years? I find it difficult to comprehend the next 30 years (starting off with 0.1% cash rates) will be like the last 30 years (starting off with 15% cash rates).

Secondly, the covid bounce back. Our most recent experience with a recovery in the share market is during 2020-2021. What if we don’t have governments globally buying bonds to influence the share market this time around? What if it’s a long cold winter for asset prices and company earnings?

Again, I’m not suggesting these things will happen because I have no idea of what's on the cards. Anything is possible. Like my mate Paul says 'if you think the market will do something, it'll end up doing the opposite'.

That said, behaviourally nothing has changed for me. I’m continuing to stick to my plan irrespective of what the market does or what people are saying/projecting.

Let's see what unfolds in October and the final quarter of 2022.